In today’s fast-paced world, it’s all too common to find yourself trapped in the cycle of owing money. Whether it’s credit card debt, student loans, or unexpected medical bills, debt can easily become a burden that hinders financial freedom and peace of mind.

But here’s the good news: there’s a way out.

By using a combination of proven strategies and a shift in your financial mindset, you can break free from the shackles of debt.

In this comprehensive guide, we’ll walk you through a step-by-step plan on how to get out of debt and, more importantly, how to stay out of debt.

Here is what we have for you:

- Snowball Your Way to Freedom with The Debt Snowball Method

- Making a Budget that Works

- Having a Starter Emergency Fund as a Buffer Against the Unexpected

- Using Passive Income Streams and Side Hustles to Increasing Your Income

- How to Negotiate Lower Fees and Interest Rates

- Celebrate the Wins by Tracking the Progress of Your Debt Payoff

- How to Avoid Scams and Debt Traps

- Protecting Your Rights and Dealing with Collectors

- How to Boost Your Credit Score by Accessing Better Financial Products

- Achieve Your Dreams by Setting SMART Financial Goals

- Prepare for Large Expenses with The Sinking Fund

- Adopting a Frugal Lifestyle by Living Below Your Means

- Prepaid Cards and Cash Envelopes: Controlling Spending

- Using Debt Consolidation and Balance Transfer Offers Wisely

- Dealing with the Mental and Emotional Stress of Debt

- Getting Free or Low-Cost Support and Resources

- Educating Your Kids About Debt and Money

- Investing for the Future and Planning for Retirement

Now that we’ve laid out the roadmap to debt freedom, let’s dive deeper into each section, dissecting the tactics and strategies that will enable you to break free from debt and remain debt-free.

Snowball Your Way to Freedom with The Debt Snowball Method

The debt snowball method is a well known strategy for paying off debt very fast and remaining motivated. This approach entails prioritizing your debts according to their size, not their interest rates.

Below is a breakdown of how it works:

Outline Your Debts: Start by listing all your debts, from the lowest to the highest, irrespective of their interest rates. This list becomes the foundation of your debt snowball plan.

Keep Up Minimum Payments: Keep making the minimum payments on all your debts.

Make Extra Payments: Earmark any additional funds you can spare to the least debt on your list. This might entail cutting back on non-essential expenses or creating additional sources of income.

The Snowball Effect: Once you’ve paid off the least debt, roll the amount of payment you were making toward it into the next least debt. This creates a “snowball” effect, enabling you to pay off larger debts faster.

The debt snowball method works because it offers quick wins, ensuring you stay motivated as you eliminate lesser debts. Transitioning between debts is consistent and smooth, which makes it easier to remain on track.

Making a Budget that Works

Making a budget suited for your lifestyle is crucial for successful debt minimization.

Below is a step-by-step guide:

Keep Tabs on Your Expenses: Begin by keeping tabs on all your expenses for a month. This will provide a clear picture of where your money goes.

Classify Your Spending: Segment your expenses into classes like housing, transportation, food, entertainment, and debt payments.

Assign Spending Limits: Set spending limits for each class according on your financial goals. Remain realistic and be sure that your total expenses are lower than your income.

Review and Adjust: Regularly evaluate your budget and make necessary tweaks. Monitor areas where you have a tendency to overspend and look for ways to cut back.

Starter Emergency Fund: Set aside a portion of your budget to your starter emergency fund. This will guarantee you’re ready for unforeseen expenses without depending on credit.

By making a budget that conforms to your financial goals and lifestyle, you’ll be better prepared to manage your money efficiently and prevent overspending.

Having a Starter Emergency Fund as a Buffer Against the Unexpected

Emergencies can hit at any time, and in the absence of a safety net, you may be forced to use credit to cater for unforeseen expenses.

This is where the starter emergency fund comes in to play:

Save a Minimum of $1,000: Your starter emergency fund should be at least $1,000. This amount is enough to cater for common unforeseen expenses such as car repairs or medical bills.

Keep in Separate Account: Ensure your emergency fund is in a separate account, so you’re not tempted to withdraw from it for non-emergencies.

Promptly Replenish it: When you deplete your emergency fund, prioritize replenishing it as soon as possible. This guarantees you’re always ready for life’s surprises.

Having an emergency fund means you have a financial safety net and minimizes your dependence on credit when unforeseen expenses come.

Using Passive Income Streams and Side Hustles to Increasing Your Income

To boost your debt payoff plan, explore ways to raise your income:

Part Time or Side Hustles: Side hustles are gigs or part-time jobs that you can take on to supplement your regular job. They can include selling handmade goods, freelance work or driving for rideshare services.

Have Income Streams that are Passive: Passive income needs an initial investment of time or money but keeps generating income with minimal ongoing input or effort. This might include a well-monetized blog or YouTube channel, rental properties or dividend stocks.

By increasing your income, you can speed up your debt payoff and achieve your financial goals more quickly.

How to Negotiate Lower Fees and Interest Rates

Lowering the cost of your debt can have a significant impact on your journey to debt freedom.

Below is a guide on how to negotiate lower fees and interest rates with your creditors:

Understand Your Terms: Comprehend the terms and conditions of your loans or credit agreements, which include current fees and interest rates.

Reach Out to Your Creditors: Contact your creditors to discuss your situation. Most times, they are willing to work with you if you’re going through financial hardship.

Be Polite and Persistent: When negotiating, be persistent but always keep up a respectful and polite tone.

Explore Balance Transfers: If your credit card issuer won’t reduce your interest rate, explore transferring your balance to a card with a lesser rate or making the most of a balance transfer offer.

Negotiating a reduced interest rate can substantially lower the overall cost of your debt and enable you to pay it off more quickly.

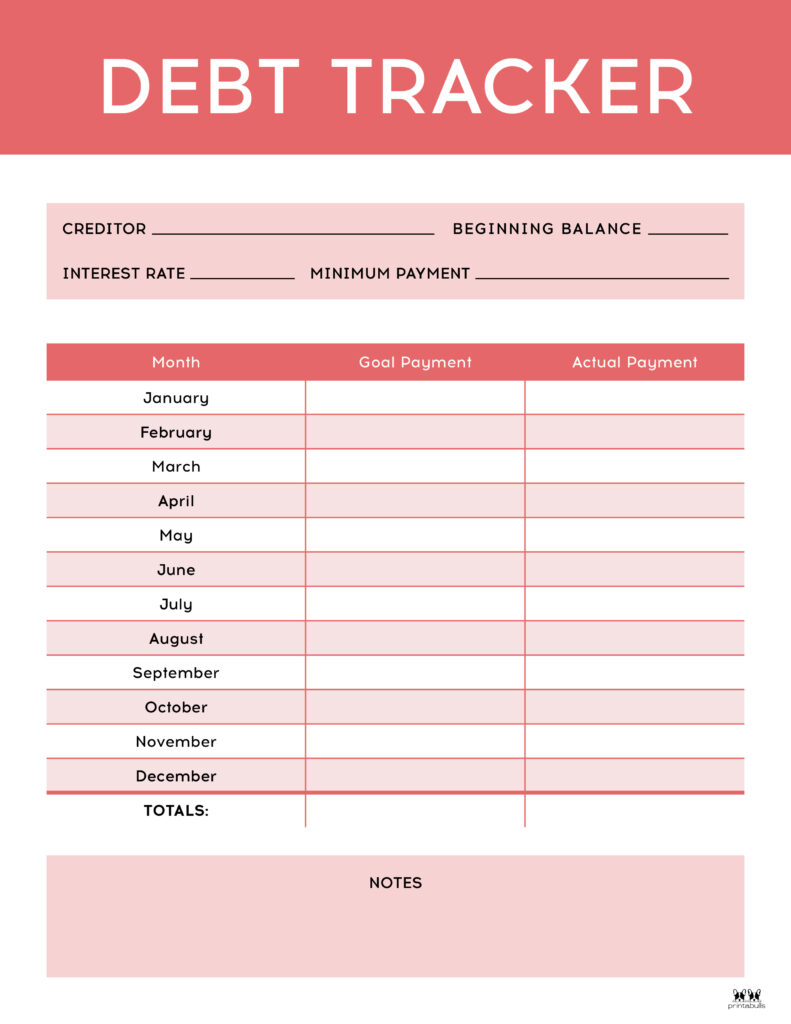

Celebrate the Wins by Tracking the Progress of Your Debt Payoff

Keeping tabs on your debt payoff progress is crucial for remaining motivated.

Below is a breakdown of how to do it effectively:

Leverage Debt Tracking Tools: There are numerous debt tracking tools and apps available that can assist you in monitoring your progress.

Assign Milestones: Divide your debt into feasible milestones, such as paying off a particular percentage or a specific debt. Celebrate these wins to remain motivated.

Your Progress Should be Visualized: Make a visual representation of your debt, like a graph or chart, to view the reduction over time.

Always Reward Yourself: Little rewards for achieving debt payoff milestones can be immensely motivating. Just be sure that the rewards are within your budget.

Keeping tabs on your progress and celebrating your achievements along the way will enable you to remain focused on your debt-free goals.

How to Avoid Scams and Debt Traps

As you are on your debt-free journey, it’s essential to be wary of common debt traps and scams that can impede your progress.

Below are some red flags to look out for:

Avoid Payday Loans: Stay away from payday loans with interest rates that are exorbitant and can cage you in a cycle of debt.

Be Wary of Debt Settlement Companies: Be wary of debt settlement companies that offer to drastically reduce your debt but usually charge high fees and may harm your credit.

Avoid Credit Repair Scams: Scammers promising quick fixes for bad credit usually prey on vulnerable individuals. Be cautious of any service that seems too good to be true.

Credit Cards with High-Interest: Refrain from building debt on high-interest credit cards, as this can make it almost impossible to pay down your balances.

Being aware is your best defense against these scams and traps. Be sure to research any financial decision thoroughly and be wary when approached by companies making big promises.

Protecting Your Rights and Dealing with Collectors

Understanding your rights and how to handle them is essential, if you find yourself in a situation where debt collectors are involved.

Here is how:

Be Aware of Your Rights: Be conversant with the Fair Debt Collection Practices Act (FDCPA), which states your rights as a debtor.

The Debt Should be Verified: Request that the collector verifies the debt in writing. This guarantees that you’re dealing with a legitimate debt.

Determine Communication Boundaries: You have the right to determine when and how debt collectors can make contact with you.

Solicit Legal Advice: If you are convinced a collector is violating your rights, solicit an attorney who specializes in debt collection issues.

Handling collectors can be stressful, but knowing your rights and how to enforce them will safeguard your financial well-being.

How to Boost Your Credit Score by Accessing Better Financial Products

A credit score that is higher can open the door to better financial opportunities and products.

Below is a guide on how to improve your credit score:

Evaluate Your Credit Report: Get a copy of your credit report and evaluate it for discrepancies or errors. Contest any inconsistencies with the credit reporting agencies.

Pay Bills Promptly: Continuously paying your bills promptly is one of the most essential factors that impacts your credit score.

Credit Utilization Should be Managed: Be sure to keep your credit card balances low in comparison to your credit limits. High credit utilization can affect your score negatively.

Credit Types Should Diversified: A variation of credit types, like credit cards, installment loans, and a mortgage, can positively affect your credit score.

Remain Patient: Building or rebuilding credit can be time consuming, so be patient and keep up good financial habits.

A higher credit score can bring about reduced interest rates on loans and access to better financial products, which ultimately saves you money.

Achieve Your Dreams by Setting SMART Financial Goals

In order to achieve success, it is crucial to set clear, specific, measurable, achievable, relevant, and time-bound (SMART) financial goals.

Here is how:

Specific: Set your financial goals in clear, specific terms. Instead of “pay off debt,” specify “pay off $1,000 in credit card debt in 6 months.”

Measurable: Ensure your goals are measurable so you can monitor your progress. Make use of numbers and dates to quantify success.

Achievable: Be sure your goals are realistic and achievable within your present financial situation.

Relevant: Your goals should conform to your values and long-term financial objectives.

Time-Bound: Set aside a deadline for your goals. This creates urgency and enables you to stay on track.

Having SMART goals will provide clarity and motivation as you work toward becoming debt-free.

Prepare for Large Expenses with The Sinking Fund

Large, irregular expenses such as annual insurance premiums or holiday spending can negatively impact your budget.

Developing a sinking fund can help:

Determine Upcoming Expenses: Create a list of large expenses you know will arise, together with their estimated costs.

Identify Monthly Contributions: Divide the approximate cost of each expense by the number of months till it’s due. This gives you the amount you are required to save every month.

Create Separate Accounts: You can use budgeting software or have separate savings accounts for each sinking fund to keep track.

Sinking funds enable you to prepare for big expenses without derailing your budget or resorting to credit.

Adopting a Frugal Lifestyle by Living Below Your Means

A fundamental aspect of staying out of debt, living below your means.

Here is how:

Separate Wants from Needs: Clearly differentiate between your wants and needs. Be focused on satisfying your needs while reducing your wants.

Always Budget Wisely: Adhere to your budget, and avoid impulse buying or expenses that are unnecessary.

Reduce Unnecessary Costs: Evaluate your monthly bills and determine areas where you can minimize expenses, like canceling unused subscriptions or looking for more affordable alternatives.

Adopt Frugality: Embrace a frugal mindset and find ways to save money in your daily life, from cooking at home to purchasing second-hand items.

Living below your means brings about financial breathing room and enables you to allocate more funds toward savings and debt repayment.

Prepaid Cards and Cash Envelopes: Controlling Spending

Curtailing your spending can be challenging, especially when using credit cards. Prepaid cards and cash envelopes can help:

Prepaid Cards: Put a set amount of money onto prepaid cards for specific expenses, guaranteeing you don’t overspend.

Cash Envelopes: Set aside a specific amount of cash to various spending categories, like groceries or entertainment. You’re done spending in that category for the month, when the envelope is empty.

These tools make it physically evident when you have run out of money in a particular category, promoting budget discipline and preventing overspending.

Using Debt Consolidation and Balance Transfer Offers Wisely

Debt consolidation loans and balance transfer offers can be valuable tools for reducing interest costs and simplifying your debt.

Below is how to use them wisely:

Review the Terms: Carefully evaluate the terms and conditions of any debt consolidation loan or balance transfer offer, paying keen attention to interest rates, fees, and repayment terms.

Weigh Up Offers: Don’t accept the first offer you receive. Weigh up multiple offers to find the one that best fits your needs.

Stay Away from New Debt: Once you consolidate your debt, be disciplined about preventing the accumulation of new debt to guarantee that you’re moving toward financial freedom.

Debt consolidation and balance transfers can help you pay off debt more effectively when used strategically.

Dealing with the Mental and Emotional Stress of Debt

The mental and emotional stress of being in debt can be inundating.

Below are some strategies to help you deal:

Solicit Support: Reach out to a trusted friend, family member, or therapist about your feelings. You will find out you are not alone in your journey.

Master Self-Care: To reduce stress, prioritize self-care activities like exercise, meditation, and relaxation techniques.

Remain Positive: Your focus should be on your progress and your end goal. Have a journal to monitor your achievements and celebrate even little wins.

Visualize the Future: Build a vision board or mental image of the life you’ll have when you’re debt-free. Utilize this vision as motivation to remain on track.

Dealing with the emotional and mental aspects of debt is crucial for your overall well-being and long-term success.

Getting Free or Low-Cost Support and Resources

There are a plethora of resources available to assist you on your debt-free journey without boring a hole in your finances.

Below are some:

Financial Websites and Blogs: A lot of websites and blogs provide free advice and resources on debt management, budgeting, and financial literacy.

Leverage Community Programs: Search for local community programs or workshops that give financial support and education.

Join Support Groups: Being part of a support group or online forum of like-minded individuals can guarantee guidance and motivation.

Make Use of Library Resources: Libraries usually provide free financial literacy workshops, books, and resources.

Making the most of these resources can boost your knowledge and ensure you are motivated on your journey to financial freedom.

Educating Your Kids About Debt and Money

Educating your children about debt and money is an essential life lesson.

Below is how to get started:

Begin Early: Start teaching your kids about money as soon as they can understand basic concepts.

Leadership by Example: Show responsible financial behavior in your own life, because children learn best by observing.

Make Use Real-Life Situations: Involve your children in age-appropriate financial decisions and discussions, like budgeting for a family vacation.

Saving Should be Encouraged: Teach the significance of saving by creating piggy banks or savings accounts.

Have Discussions about Debt: Have age-appropriate conversations about debt, interest, and responsible borrowing, as your children come of age.

Empowering your children with financial knowledge enables them to make informed decisions and manage their money wisely in the future.

Investing for the Future and Planning for Retirement

You must also plan for your future. This is because getting out of debt is just one step toward financial security.

Here is how:

Contribute to Retirement Accounts: Make contributions to retirement accounts such as 401(k)s and IRAs to secure your financial future.

Investments should be Diversified: Invest in a variety of assets, like stocks, bonds, and real estate, to increase potential returns and spread risk.

Periodically Evaluate Your Portfolio: Regularly evaluate and adjust your investment portfolio to conform to your long-term goals.

Solicit Professional Advice: Consider reaching out to a financial advisor to improve your investment strategy.

You’ll build a solid financial foundation for the future, by investing wisely and preparing for retirement.

Rounding Up

Achieving financial freedom by getting out of debt and staying out of debt is a journey that requires discipline, determination, and a well-thought-out plan. Remember that becoming debt-free is not just a financial achievement; it’s a life-changing transformation that offers you the freedom and security to pursue your dreams and live the life you’ve always envisioned.

By following the strategies outlined in this comprehensive guide, you can make significant progress toward your debt-free goals. So, take the first step today, and embark on your journey toward a brighter and debt-free future.

From using the debt snowball method to building a budget that works for you, negotiating with creditors, and protecting your financial future from debt traps and scams, you have the tools you need to succeed.

All the best!

Leave a Reply