Your credit score plays a vital role in your financial life. It affects your ability to qualify for credit cards, loans and even certain rental properties and jobs. A good credit score is more valuable than ever in today’s financial landscape.

Having a good credit score is very important in 2023. Sadly, the path to attaining a credit score that is strong isn’t always clear-cut.

This comprehensive guide will walk you through the steps to improve your credit report and build your credit score, even if you’re looking to improve your existing credit or establish credit for the first time. It will help you navigate this ever complex terrain.

Whether it’s negotiating with creditors or checking your credit score, we’ve got you covered.

Let’s get started!

- Obtaining Your Credit Report and Credit Score for Free in 2023

- How to Improve The Factors That Affect Your Credit Score

- Lowering Your Credit Utilization Ratio and Paying Off Debts

- Correcting and Disagreeing with Errors on Your Credit Report

- Making Use of Credit Cards Responsibly to Improve Your Credit Score

- Using and Applying for Credit Builder Loans and Secured Loans

- Increasing Available Credit and Diversifying Your Credit Mix

- Preventing Negative Marks, Collections and Late Payments

- Safeguarding Your Credit Score from Fraud and Identity Theft

- Requesting Goodwill Adjustments and Negotiating with Creditors

- Leveraging Credit Repair Agencies and Services

- Gaining from The Latest Changes in Credit Scoring Models in 2023

- Choosing Realistic Credit Score Goals and Monitoring Your Progress

- Leveraging Online Tools and Resources to Boost Credit

- Benefiting from Successful Credit Score Tips and Stories

- Leveraging Your Improved Credit Score to Qualify for Better Terms

- Sustaining Excellent Credit Habits for the Long Term

Obtaining Your Credit Report and Credit Score for Free in 2023

You need to know where you stand, before you dive into the nitty-gritty of credit improvement. Fortunately, obtaining your credit report for free and checking your credit score, it’s easier now than ever. This is due to the availability of various resources.

You will easily spot discrepancies and track your progress if you regularly monitor your credit. Many credit card companies now offer free access to your FICO credit score. Also, a good number of financial institutions and websites offer this service too. Reputable apps and websites like Credit Sesame, Credit Karma or even your bank’s online portal are platforms you can also use.

It is best to check all three major credit bureaus: TransUnion, Experian and Equifax as they may have slightly different information. You can access your credit report for free once a year from each of them as they make this process straightforward.

How to Improve The Factors That Affect Your Credit Score

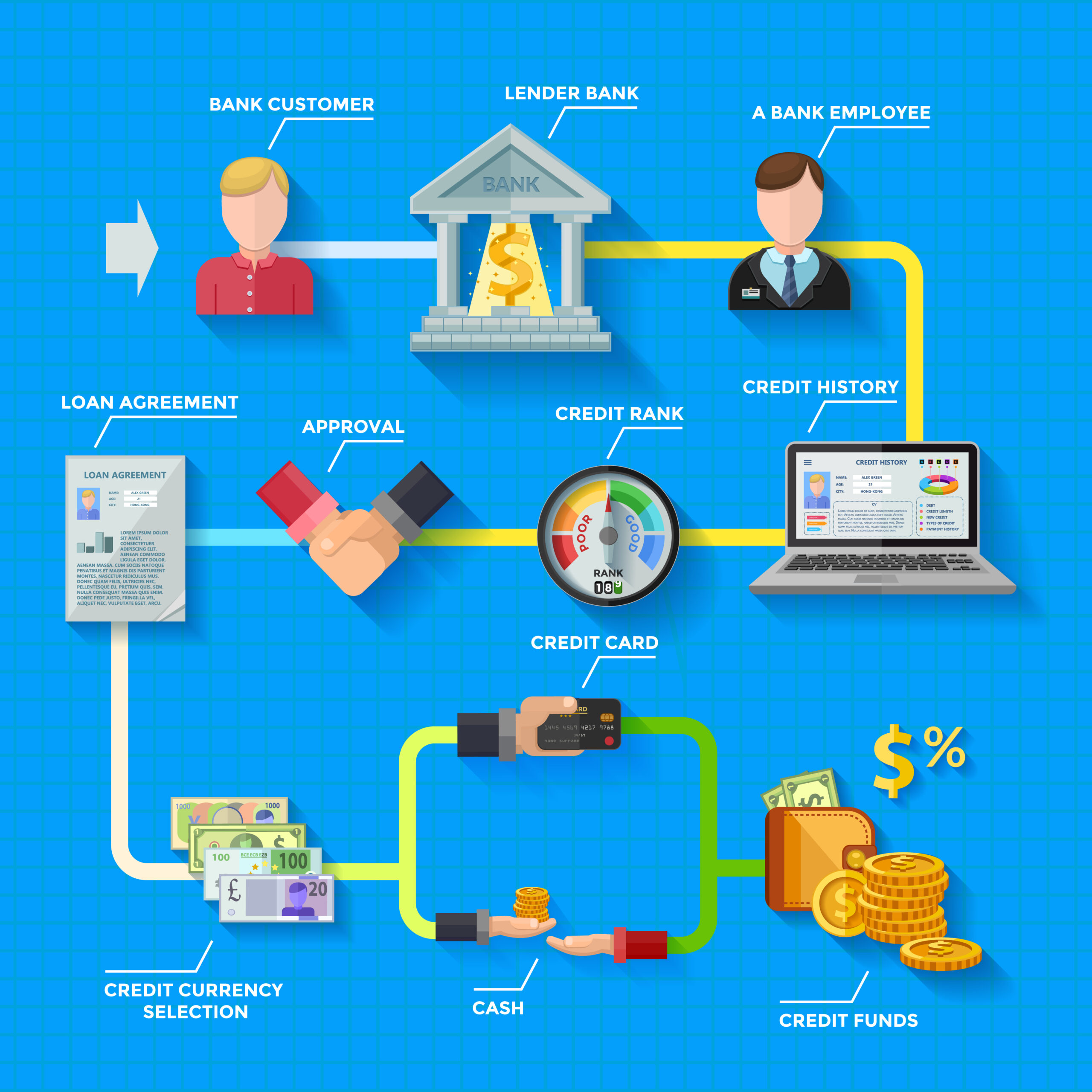

Your recent credit inquiries, types of credit, credit history length, credit utilization and payment history are some of the factors that influence your credit score. They each carry a different weight. For you to improve your score, it is crucial to understand these components

Here’s how to tackle each factor:

Your Payment History

Your payment history is the most important factor affecting your credit score. Be sure to pay your bills on or before their due dates, always. To ensure you don’t miss due dates, set up automatic payments or reminders as late payments can have a negative impact on your score, that is lasting.

Credit Utilization Ratio

Relative to your credit limits, keep your credit card balances low. The percentage of your available credit that you’re currently using is your credit utilization ratio. A credit utilization ratio that is below 30% should be your aim. Your score can be boosted quickly by lowering your credit card balances. Also, high-interest credit cards should be paid down first.

Length of Credit History

Even if you don’t use them regularly, avoid closing old credit accounts. They contribute positively to your score. You are better off with a longer credit history.

Credit Types

Your score can be positively impacted by having a mix of credit types such as mortgages, loans and credit cards. However, don’t open new credit accounts just for the sake of diversification or variety.

Latest Credit Inquiries

You run the risk of lowering your score if you apply for multiple credit accounts within a short time frame. Avoid it, as your score is lowered slightly for each hard inquiry made by lenders. This is because it often counts as one inquiry when you make multiple inquiries for the same type of credit within a short time.

Lowering Your Credit Utilization Ratio and Paying Off Debts

A crucial step in improving your credit score is reducing your outstanding debts. Tackling your existing debts head-on, is one effective way to boost your credit score. Paying down high-interest credit card balances is the best way to start. To systematically reduce your debt load, consider creating a debt repayment plan.

Additionally, your score is swiftly impacted by lowering your credit utilization ratio. Focus on avoiding maxing out your cards and paying down credit card balances.

Here are some strategies:

Debt Consolidation

Consider consolidating balance transfer credit cards with a lower interest rate or high-interest debts with a personal loan. This can reduce interest costs and simplify your payments.

Snowball Method

Focus on paying off the smallest balance first after listing your debts from smallest to largest. Move on to the next smallest debt, once that’s paid. This approach provides a sense of motivation and accomplishment.

Avalanche Method

Debts with the highest interest rates should be prioritized. You’ll save money in the long run, by paying off high-interest debts first.

Correcting and Disagreeing with Errors on Your Credit Report

Credit reports are not flawless. Errors on your credit report can have an adverse effect on your credit score. Your credit score can potentially be harmed when this occurs. Dispute any errors or discrepancies you find on your credit report and regularly review it for inaccuracies. The law mandates credit bureaus to investigate and correct errors. They have mechanisms in place for this purpose, and you can dispute errors online.

To dispute an error:

- The credit bureau reporting the error should be contacted .

- To support your claim, provide documentation.

- Follow up and monitor the progress until the error is resolved.

Making Use of Credit Cards Responsibly to Improve Your Credit Score

When used wisely, credit cards can be powerful tools for building credit. They can be both a blessing and a curse for your credit score. The key to improving your credit profile is using them responsibly.

Here are some tips:

Pay Balances in Full

Avoid paying unnecessary interest by carrying a balance. Your credit card bill should be paid in full every month. This is to avoid interest charges.

Maintain a Low Utilization

Aim for a credit utilization ratio below 30%, as mentioned earlier. Your score can be hurt by having high balances relative to your credit limit.

Stay Away From Opening Too Many New Cards

Your score is potentially lowered for each new credit card application because it can result in a hard inquiry on your credit report. You should only apply for new cards when necessary.

Keep Old Accounts Open

Your credit history length can be shortened by closing old credit card accounts. It can also negatively impact your credit utilization ratio. Even if you seldom use them, keep your older accounts open.

Using and Applying for Credit Builder Loans and Secured Loans

Credit builder loans and secured loans can be beneficial, if you’re rebuilding credit or starting from scratch. These loans can help establish a positive payment history as they typically have lower approval requirements. They are designed to help you establish or rebuild your credit history.

Credit builder loans hold the loan amount in a savings account until it’s paid off while secured loans require collateral. When payments are made on time, both options help build credit. This is because you demonstrate responsible credit usage, by making payments on-time.

Increasing Available Credit and Diversifying Your Credit Mix

You can improve your credit score by having a mix of credit types, such as mortgages, installment loans and credit cards. However, unnecessary opening of new accounts should be avoided. An additional credit should only be taken on when needed.

Your credit utilization ratio can also be lowered by increasing your available credit (credit limits). On your existing credit cards, you can request credit limit increases. It can increase your available credit.

Preventing Negative Marks, Collections and Late Payments

Your credit can be severely damaged by negative marks, collections and late payments. Their presence on your credit report can be disastrous for your credit score. To ensure you never miss a due date, set up reminders or automatic payments. Contact your creditors to discuss possible alternatives like hardship programs or deferred payments, if you’re struggling to make payments.

Below is a breakdown on how to avoid them:

Initiate Payment Reminders

To ensure you pay bills on time, use calendar reminders or automatic payments.

Effective Communication with Creditors

Contact your creditors to discuss payment arrangements or hardship programs, if you’re facing financial hardship. This should be done before your accounts go to collections.

Regularly Check Your Credit Report

You can catch and address issues early by monitoring your credit report helps, and as a result, prevent negative marks.

Safeguarding Your Credit Score from Fraud and Identity Theft

You can catch any unusual activity early by monitoring your credit score regularly. Consider enrolling in credit monitoring services because fraud and Identity theft can wreak havoc on your credit. You are alerted to any suspicious activity with the help of these services.

Protect yourself by:

Monitoring Your Accounts Regularly

Scrutinize your credit card and bank statements for unauthorized transactions.

Making Use of Strong Passwords

Consider two-factor authentication and be sure to use unique and strong passwords for financial accounts.

Credit Freezing

To prevent unauthorized access, consider freezing your credit reports.

Requesting Goodwill Adjustments and Negotiating with Creditors

Consider reaching out to your creditors. You can request “pay for delete” agreements or goodwill adjustments, if you have a good relationship with a creditor and a history of on-time payments. Negative items from your credit report can be removed by these actions.

To negotiate successfully:

- Contact the collection agency or creditor.

- Request a goodwill adjustment or pay for delete, after explaining your situation.

- Ensure any agreements reached are in writing.

Leveraging Credit Repair Agencies and Services

You may want to explore credit repair services and agencies, if your credit needs significant improvement. These professionals can help negotiate with creditors on your behalf and navigate the dispute process. Your credit report can be improved by credit repair services, but you have to be cautious. Some services charge high fees and some others make false promises. Research the company’s reputation before working with them.

Before using a credit repair service, do the following:

- Investigate the company’s reviews and reputation.

- Verify their fees and the services they offer.

- Many tasks can be done on your own, so consider DIY credit repair first.

Gaining from The Latest Changes in Credit Scoring Models in 2023

Keep abreast of changes in credit scoring models. They can change over time. Some models may place less emphasis on certain negative factors in 2023. These factors include medical debt or tax liens. Stay informed about these new updates. You can strategize your credit improvement efforts by understanding these changes.

Choosing Realistic Credit Score Goals and Monitoring Your Progress

Set credit score goals that are achievable and track your progress, as it is crucial for your financial journey. It’s essential to have a defined target and measure your success as you progress. Adjust your strategies as needed. To keep an eye on your score, you can use credit monitoring services. Monitor your progress and. Remember that it takes consistent effort, time and patience to improve your credit score.

Leveraging Online Tools and Resources to Boost Credit

To help you improve your credit, numerous online tools and resources are available. Some of these resources include educational websites, credit score simulators and budgeting apps. To make informed financial decisions, take advantage of these resources. They can help you learn about financial literacy, create budgets and track your credit.

Benefiting from Successful Credit Score Tips and Stories

Individuals who have successfully improved their credit scores are a great source of inspiration. Seek advice and inspiration from them as well as experts in the field. They can offer valuable insights into what works. Success stories and tips from people who have rebuilt their credit are often featured on financial websites, social media groups and online forums.

Leveraging Your Improved Credit Score to Qualify for Better Terms

You can qualify for better interest rates and loan terms, once your credit score improves. You become more attractive to lenders, as your credit score improves. This can save you money in the long run, as it results in better interest rates and loan terms. As a result, you can save money on loans and credit cards. To take advantage of your improved credit profile, consider refinancing existing loans. When applying for new credit, be sure to shop around for the best terms and rates.

Sustaining Excellent Credit Habits for the Long Term

Continue practicing good financial habits in order to maintain a strong credit profile. This is because improving your credit score is only the beginning. Avoid taking on more debt than you can handle, keep credit card balances low and pay bills on time. Improving and building your credit is a continuous process.

To maintain your good credit score:

- Keep paying bills on time.

- Maintain low credit card balances.

- Unnecessary credit applications should be avoided.

- Your credit report should be reviewed regularly for errors.

Conclusion

In 2023, improving and building your credit score requires knowledge, patience and commitment. You can achieve your credit score goals and enjoy the financial benefits of good credit by staying informed about credit-related changes and following these steps. Remember that the foundation of a strong credit profile are responsible financial habits. So, treat it with the care it deserves. Finally, always make sound money decisions in order to secure a bright financial future.

All the best!

Very Informative!

Thanks for your review.

I am glad you found it helpful!