Your financial well-being can be significantly impacted by inflation, the steady rise in prices over time. It is an economic phenomenon that entails the gradual increase in the prices of goods and services. It has a far-reaching impact on our financial lives.

As the world faces economic fluctuations in 2023, a crucial question to consider is “How to calculate your personal inflation rate and why it matters”. Learning how to calculate your personal inflation rate and why it matters is critical for every individual. It has become an essential skill in 2023

Your purchasing power diminishes, as prices increase affecting your savings, debt and investments. The value of money diminishes, as prices rise over time. It erodes purchasing power, necessitating prudent planning for the future.

In this extensive guide, we’ll dissect ten essential strategies to ensure your financial stability and navigate inflation’s challenges. You will learn strategies that enable you to plan, budget and navigate an inflationary environment effectively, protecting your finances from inflation’s grasp. You will have a handle on ways to safeguard your finances and protect your purchasing power.

Let’s Get Started!

- Understanding the Consequences and Causes of Inflation

- Determining Your Personal Inflation Rate

- The Impact of Inflation on Debt, Investments and Savings

- Safeguarding Your Purchasing Power in 2023

- Future Planning and Budgeting in an Inflationary Environment

- Dealing with Lower Income and Rising Prices

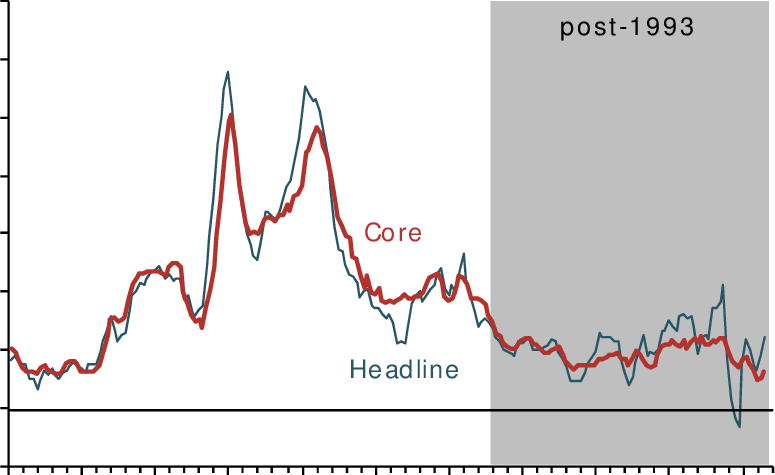

- Understanding The Difference between Headline and Core Inflation and Their Impact

- Avoiding Pitfalls and Taking Advantage of Inflation Opportunities

- Effective Inflation Management Strategies

- Thriving and Adapting During Inflation

1. Understanding the Consequences and Causes of Inflation

It’s essential to grasp the root causes and consequences of inflation, before diving into strategies. To comprehend the potential consequences of inflation, it is critical to understand its root causes. Hence, comprehending its underlying causes and consequences, it’s important.

Inflation is often triggered by a surge in demand, increased production costs or supply shortages. Factors like excessive money supply, supply chain disruptions or demand shocks, can result in inflation. Some of the primary drivers are demand-pull inflation, built-in inflation and cost-push inflation.

It reduces your ability to buy goods and services, eroding the value of money, when left unchecked. Reduced purchasing power, challenges in long-term planning and uncertainty in financial markets are some of its consequences. The foundation for effective inflation management is formed by this understanding. You are empowered to make informed financial decisions by understanding these dynamics.

2. Determining Your Personal Inflation Rate

Tracking the price changes of goods and services you regularly consume, is what is involved when calculating your personal inflation rate. How your expenses are affected by inflation, is reflected by your personal inflation rate. You track this rate to understand how price increases impact your finances and lifestyle. Calculating your personal inflation rate is the first step to understanding the real impact of inflation on your finances.

You gain a clear picture of how inflation impacts your daily life, by comparing these changes to your income. Track your spending on essential items, compare costs over time, and then adjust for any lifestyle changes, to accurately calculate your inflation rate. This means comparing the cost of a fixed basket of goods and services and tracking your spending patterns over time.

You are enabled to stay informed about your financial circumstances, by numerous online tools and apps that simplify this process. The first step toward making informed financial decisions in an inflationary environment, is understanding your personal inflation rate. You gain insight into how inflation specifically affects your financial circumstances and lifestyle, by doing so.

3. The Impact of Inflation on Debt, Investments and Savings

The reach of inflation extends to your liabilities and financial assets. Inflation affects your savings, debt and investments, eroding the purchasing power of your money. Inflation affects all aspects of your financial portfolio, it doesn’t discriminate.

Fixed-interest investments may not keep pace with inflation and cash savings lose value as prices rise, effectively eroding your returns. If the rate of inflation surpasses your returns, the real value of your nominal savings could decline even when it increases. Low-interest investments or savings held in traditional savings accounts lose value as their purchasing power diminishes.

While the real value of debt decreases, you’re still bound to make repayments at the original borrowing amount. Debt can be a double-edged sword. Similarly, while your debt burden might seem lighter in nominal terms but might not decrease in real terms, high inflation can impact the real value of your investments. Debt can be both a boon and a bane: variable-rate debt becomes costlier, while fixed-rate debt becomes cheaper over time.

4. Safeguarding Your Purchasing Power in 2023

Diversify your portfolio with assets that historically perform well during inflationary periods, to shield your purchasing power from inflation. Consider investing in assets that historically outpace inflation, to protect your purchasing power from inflation. Safeguarding your purchasing power is paramount, given the omnipresence of inflation.

Real estate, inflation-protected bonds and commodities like gold, are some of the best inflation-proof assets and strategies for your portfolio. Certain types of stocks that tend to perform well during inflationary periods are also included. Holding a mix of assets – from real estate and stocks to commodities and precious metals – can provide a buffer against inflation’s erosive effects. Diversification becomes a key principle.

These assets tend to appreciate in value, as prices rise providing a hedge against inflation. You can maintain your purchasing power over time, by allocating a portion of your portfolio to these assets.

5. Future Planning and Budgeting in an Inflationary Environment

In inflationary times, budgeting takes on heightened importance. Your budgeting and financial planning strategies need adjustment, in an inflationary environment. This is because inflation disrupts budgeting norms.

To account for rising expenses, create a comprehensive budget. Allocate a portion of your budget to investments that can counteract inflation’s effects. Prioritize needs over wants. Focus on building an emergency fund to cushion against unexpected price spikes and make a flexible budget that accounts for skyrocketing costs. It’s imperative to maintain a focus on your long-term financial goals while adjusting your budget to account for rising costs.

To ensure your financial plan remains aligned with changing economic conditions, regularly revisit and adjust your budget. Moreover, consider potential inflation effects on your retirement income needs as you revisit your retirement planning. Embracing conscious spending and prioritizing needs over wants become key aspects of successful budgeting during inflation.

6. Dealing with Lower Income and Rising Prices

Coping with inflation can be particularly challenging for those on fixed incomes or facing reduced earning potential. You require proactive measures to master how to cope with rising prices and lower income in 2023. It requires a proactive approach to cope with inflation. Prioritize needs over wants and keep track of your expenses. When combined with stagnant or reduced income, inflation can be particularly challenging.

To enhance your employability, seek additional income streams, consider acquiring new skills and explore job opportunities. Remaining competitive in an evolving job market, involves investing in upskilling or augmenting your income through side gigs. Consider strategies such as renegotiating existing contracts and exploring additional income streams.

It can also help to stretch your budget further by negotiating better deals and discounts. Look for cost-saving measures, such as seeking out discounts or buying in bulk. Explore ways to reduce discretionary spending and prioritize essential expenses.

7. Understanding The Difference between Headline and Core Inflation and Their Impact

Headline inflation is the overall rise in prices with volatile sectors like energy and food included. Headline inflation grabs headlines and reflects the overall change in prices. It accounts for all goods and services.

These volatile elements are excluded in core inflation to provide a clearer picture of the underlying inflation trend. Core Inflation often gives a relatively accurate picture of long-term price trends.

Understanding the difference empowers you to gauge the true impact of rising prices on your financial situation as both indicators offer valuable insights. It can help you gauge the impact of inflation on your everyday expenses by understanding this distinction. Distinguishing between headline and core inflation is essential to comprehend inflation’s nuances.

8. Avoiding Pitfalls and Taking Advantage of Inflation Opportunities

Inflation also presents opportunities, it doesn’t solely entail challenges. Historically, well-managed businesses and real estate have thrived during inflationary periods. In industries that thrive during inflationary periods, inflation can offer unique investment opportunities. Industries such as energy and commodities. Investing in these sectors can yield profitable returns. Inflation creates opportunities for savvy investors.

However, not all investments do well in these conditions. It’s crucial to conduct thorough research and tread carefully before investing. Caution is advised to avoid speculative or overly risky investments that promise quick gains.

Avoid long-term bonds, cash investments and fixed-interest savings, that might lag behind rising prices. The real value of your debt could increase over time so be cautious of debt accumulation during inflation.

9. Effective Inflation Management Strategies

A combination of investing in inflation-resistant assets, cultivating financial literacy and adjusting your budget make up strategies for effective inflation management. Careful consideration is required to craft an inflation-proof portfolio.

Stay attuned to economic indicators that signal changes in inflation trends, while reviewing and rebalancing your investment portfolio regularly. It can help you maintain stability in an inflationary environment when you balance risk and reward, stay informed about market trends and diversify across asset classes. When you balance risk and reward, diversify across asset classes and stay informed about market trends, it can help you maintain stability in an inflationary environment.

The key to safeguarding your portfolio against inflation is diversification. Consider Treasury Inflation-Protected Securities (TIPS), which provide returns linked to inflation, in addition to real assets.

Also, due to their intrinsic value and historical price trends, precious metals like silver and gold also serve as a hedge against inflation.

10. Thriving and Adapting During Inflation

Your ability to adapt and thrive remains essential as the economic landscape evolves. In an inflationary environment, the path to a prosperous financial future involves education and adaptability. Some assets are more resilient to inflation than others.

Your allies in securing your financial well-being in an inflationary environment will be staying informed about the latest economic trends and continuous learning about financial matters. Be acquainted with policy changes and economic trends that might impact inflation. Seek guidance from financial experts when needed and embrace a proactive approach to managing your finances.

Ensure your investment choices and financial strategies align with your long-term goals, continuously reassess them. During inflationary periods, tangible assets like precious metals and real estate tend to hold or even increase in value. Equities can also provide a hedge against rising prices especially those of companies with pricing power.

Conclusion

With the right strategies, you can navigate challenges arising from inflation and even identify opportunities for growth, even if its impact on your finances can be significant. Informed decision-making and proactive planning is required to understand and navigate the complexities of inflation in 2023 . Inflation necessitates adaptive financial strategies as an inherent feature of economies. The impact of inflation on our finances cannot be underestimated as we navigate 2023.

You’ll be well-equipped to protect your purchasing power and achieve financial stability in 2023 and beyond by calculating your personal inflation rate, adopting inflation-resistant asset allocation and understanding its effects on savings, debt and investments. You can protect your finances from the erosive effects of rising prices, by adapting your budgeting and investment strategies. Inflation presents opportunities for those who are prepared and equipped with the right knowledge to secure their financial well-being in an economic landscape that is dynamic, albeit challenging.

Remember that staying informed and adapting to changing economic conditions are key to securing your financial success in an inflationary environment. Budgeting prudently, calculating your personal inflation rate and diversifying your portfolio with inflation-proof assets are all essential components of a successful financial plan. You can position yourself to mitigate risks and seize opportunities, by understanding causes and consequences of inflation, hence, ensuring a secure financial future in an inflationary environment.

All The Best!

Leave a Reply